Financial Services, Your Way.

The future of leading-class banking is achieved by those who capitalize on the pace of change and innovation. Hitachi Digital Services can help you accelerate digital maturity, create real customer value, and steer your path to success.

Banking and Financial Services

The future belongs to those who capitalize on change. The right partner can help you accelerate digital maturity, create real customer value, and steer your path to success.

Meet Our Customers

MSRB Brings Greater Insights to the Municipal Securities Market With a Cloud Data Lake

Portfolio+ Meets Customer Demand For SaaS Open Banking Services With Cloud Migration

Modernize Regulatory Data Management and GRC

The Governance, Risk Management, and Compliance (GRC) landscape is changing rapidly, creating an environment where both opportunities and challenges abound.

What happens when you prioritize GRC modernization?

Read eBookKey GRC Resources

Managing Financial Services Risk and Compliance

Read how our Risk and Compliance services are helping financial institutions prepare for new risk scenarios and reduce the cost of compliance.

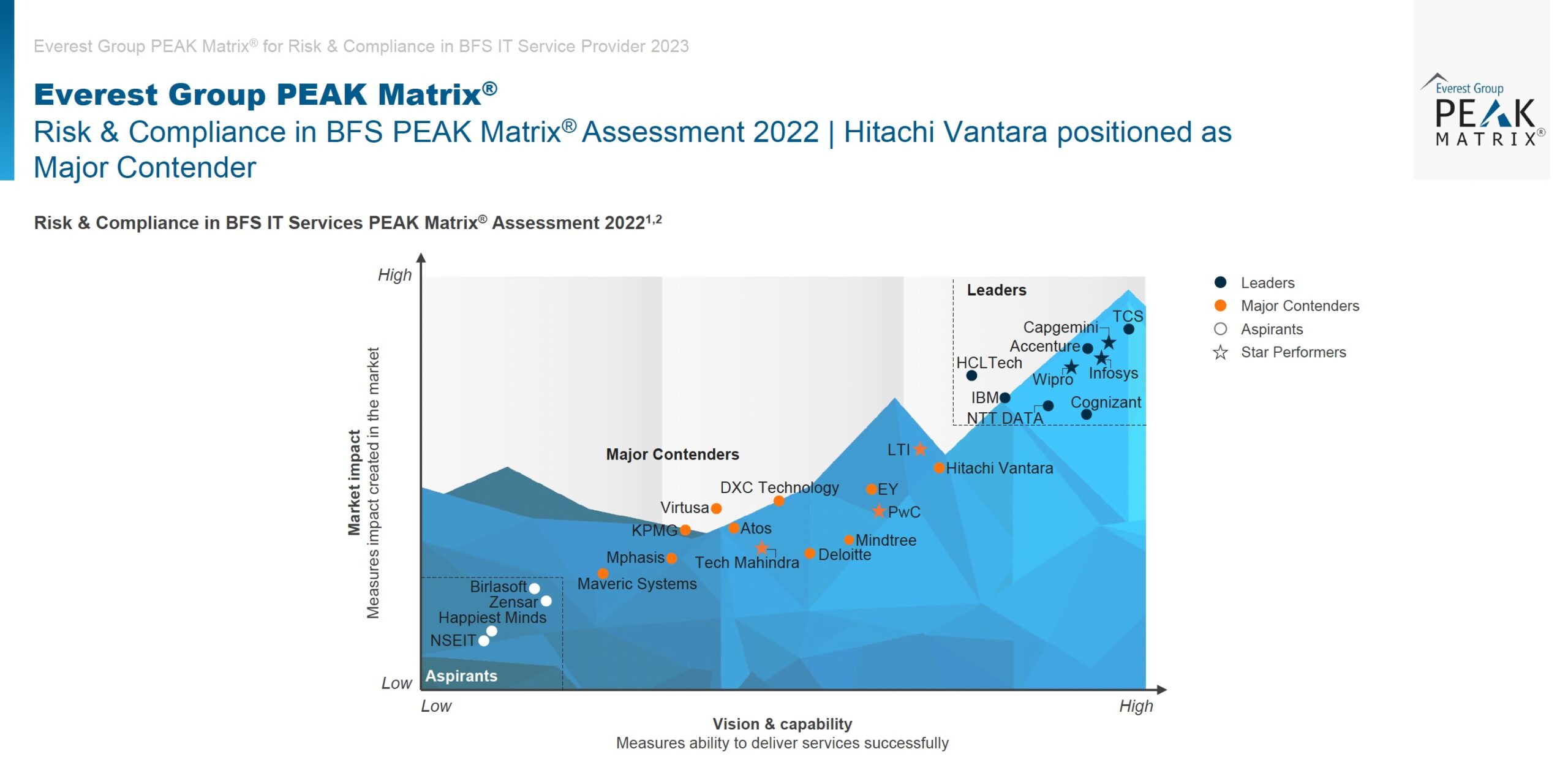

Hitachi Digital Services is Named a Major Contender in R&C

Hitachi Digital Services was named a Major Contender in the Everest Group PEAK Matrix for Risk and Compliance in BFS IT Services.

Hear From the Experts

Stewart is a distinguished leader in the realm of insurance technology and innovation. With an impressive tenure of 7 years within the company and a remarkable career spanning over 27 years in the insurance technology space, Stewart brings a wealth of experience and expertise to the forefront.